Partner at Golden Gate Ventures

Kauffman Fellow Class 20

Born-again Dog Lover

Kettlebell Junky

Gaming Nerd

Hi, I’m Justin.

I’m a dad to four dogs, possess an embarrassing weakness for strategy games and Seinfeld (#thesepretzels), and originally hail from Brooklyn (Flatbush Gang ayyye).

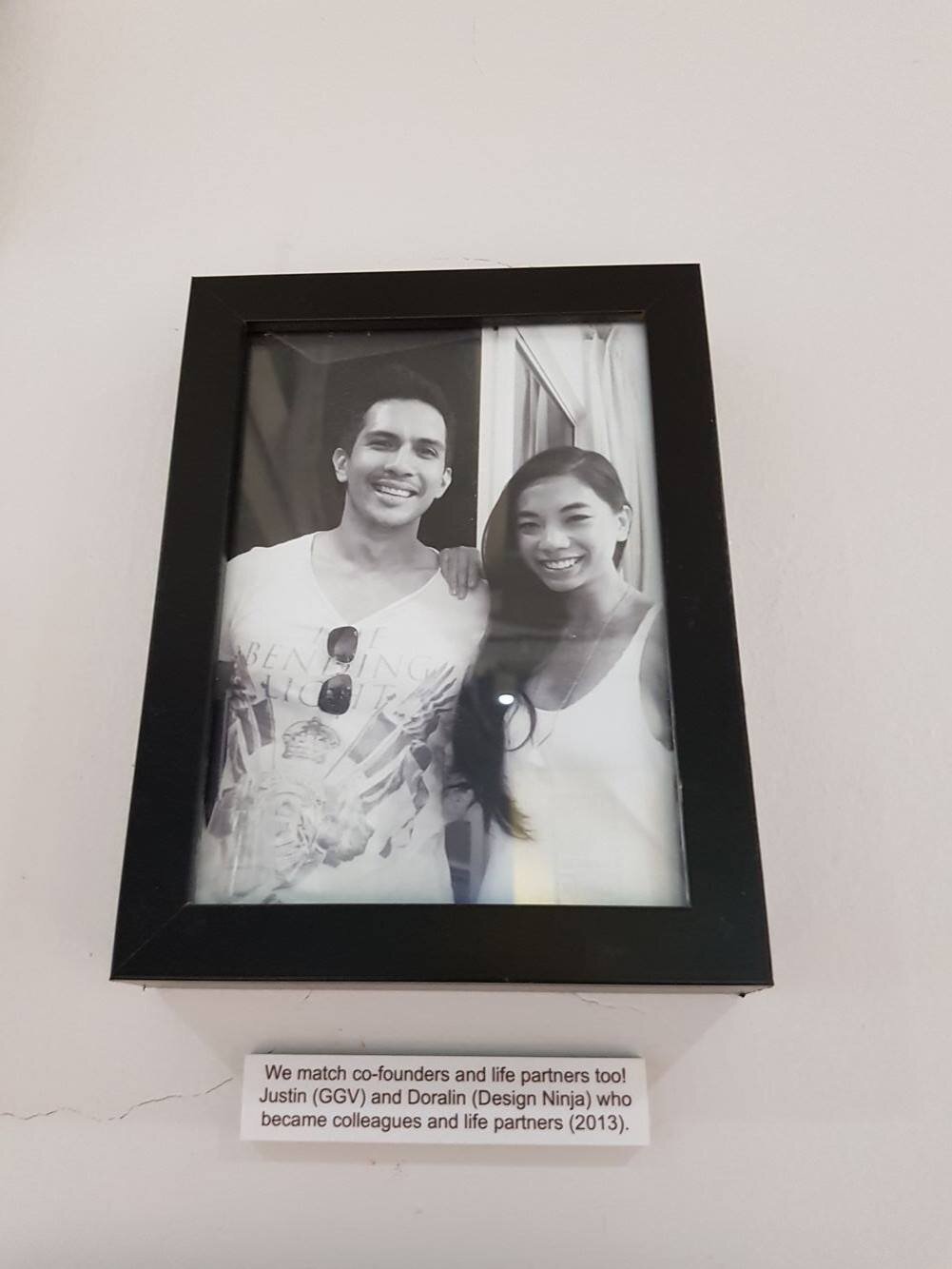

I worked at Rakuten for several years before moving to Singapore in June 2011, and I joined Golden Gate Ventures — surprise, surprise! — as an intern May 2012. Six years later, I became partner.

Before Golden Gate Ventures, I was a scholar of the National University of Singapore’s Lee Kuan Yew School of Public Policy, where I graduated with a Masters in Public Policy, and prior to that I matriculated with honours at Trinity College, Dublin, with a degree in history and political science.

Today I get to work with some of the best entrepreneurs, investors, and mentors in Southeast Asia. Sure, 32°C is considered ‘balmy’, I’m on a plane every other week, and I need to know how to order coffee in five different languages to survive, but I can’t ask for a better place to be or better people to work with.

click here if you need a more detailed curriculum vitae (and fancy headshot!)